- Where We Do Business

- When do you need a will?

- SFA At a Glance

- The Nautilus Group®

- Newsletters

- Eagle Strategies, LLC

- Individual Planning

- Events on Wall Street

- Our Involvement

- Resources for Professional Advisors

- SFA Blog

- Our Location

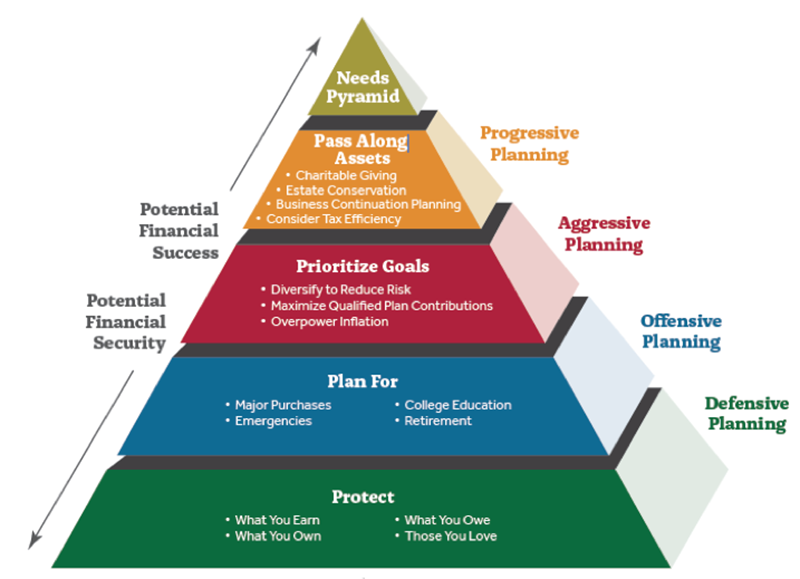

- Planning Process

- Will you pay the AMT?

- Should you tap retirement savings to fund college?

- Risk Management Planning

- Retiring the 4% Rule

- Where is the market headed?

- What Smart Investors Know

- The Richest Man in Babylon

- Safeguard Your Digital Estate

- A Bucket Plan To Go With Your Bucket List

- The Rule of 72

- The Investment Process

- Our Strategic Partnerships

- Executive Planning & Benefits

- Estate Management 101

- Video Learning Library

- Estate & Legacy Planning

- Group Benefits

- Concept Pieces on Planning Strategies

- Life Plan for your Business

Risk Management PlanningA comprehensive financial plan should absolutely address the need for proper risk management and insurance coverage. We can assist you in identifying the proper types and amounts of insurance that are appropriate for your individual situation. You should carefully consider what cash flow or future income may need to be replaced in the event of your death or disability. Your own human capital may well be your greatest asset. Term and Perm Life InsuranceProtecting your family, your business and your legacy are presumably priorities. The proper insurance structure can provide much more than just lump sum distributions upon your death. Insurance can be the cornerstone of your overall wealth management program, whether you are in the accumulation, preservation or distribution phase of your financial life. Our recommendations are always made with your unique tax situation in mind, as we seek to maximize after-tax returns for all of our clients. We address all aspects of your financial life to ensure a coordinated plan is developed and addresses:

|

Contact Info

6901 Rockledge Drive, Suite 700

Bethesda, MD 20817

Map and Directions

Phone: (301) 214-6700

Fax: (301) 214-6653

Quick Links

Quick Links

6901 Rockledge Drive, Suite 800

Bethesda, MD 20817

Phone: (301) 214-6700

Fax: (301) 214-6653