- Where We Do Business

- When do you need a will?

- SFA At a Glance

- The Nautilus Group®

- Newsletters

- Eagle Strategies, LLC

- Individual Planning

- Events on Wall Street

- Our Involvement

- Resources for Professional Advisors

- SFA Blog

- Our Location

- Planning Process

- Will you pay the AMT?

- Should you tap retirement savings to fund college?

- Risk Management Planning

- Retiring the 4% Rule

- Where is the market headed?

- What Smart Investors Know

- The Richest Man in Babylon

- Safeguard Your Digital Estate

- A Bucket Plan To Go With Your Bucket List

- The Rule of 72

- The Investment Process

- Our Strategic Partnerships

- Executive Planning & Benefits

- Estate Management 101

- Video Learning Library

- Estate & Legacy Planning

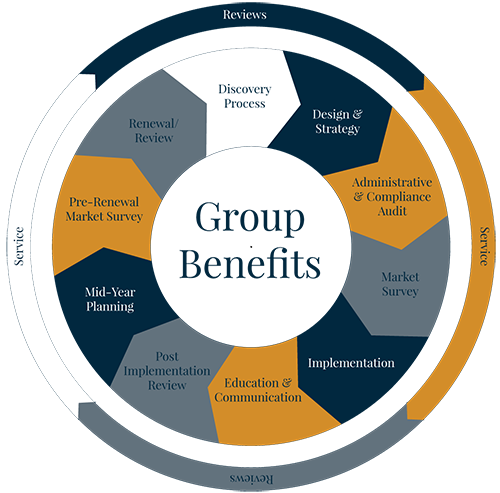

- Group Benefits

- Concept Pieces on Planning Strategies

- Life Plan for your Business

Group BenefitsGroup Benefits PlanningOur approach to benefits consulting starts with a thorough assessment of all existing benefit programs in an effort to highlight any inefficient components. Our evaluation considers historical claim utilization data, demographic information, employee contribution strategy and current benefit plan offerings. Based on our findings, we will tailor a program that meets both the fiscal requirements of our clients as well as the well-being of their employee population. If the core benefits program alone is unable to provide a sustainable solution, our expertise with voluntary benefits allows us the flexibility to implement a properly balanced combination of employer-sponsored core benefits and employee-paid voluntary plans. Our expertise in management of health plan expenses encompasses the continuum of traditional network based managed care plans such as PPO, POS and HMO, to consumer directed programs including HRAs and HSAs for both fully insured and self-funded plans. Our knowledge of the marketplace allows us to identify the most cost-efficient vendors for ancillary services including employer and/or employee paid dental, Life/AD&D and disability.  Department OverviewAccount SupportOur Group Benefit Managers are available to help you troubleshoot claims, billing, and enrollment issues. Your dedicated Group Benefits Manager also is able to order any additional supplies you may need, such as enrollment kits, directories, forms, etc. New Business ProcessingThe New Business Department processes the initial paperwork for your group benefits. They will contact you for missing or additional items needed to implement your policy. They will notify you upon approval. RenewalsOur Renewal Specialists will contact your group 60 to 90 days prior to renewal. They will review your benefits package and inquire if you would like to enhance or change your existing plan upon renewal. They will also find out if there have been any major changes to your company within the last 12 months. Group BenefitsYour Group Benefits Consultant will review your needs and shop and compare premium rates and benefit options with the most established insurance carriers. Because we represent every major insurance carrier in the industry, your Benefits Consultant can customize and design a benefits package that is right for you. 401(k) / Retirement PlansIf you are interested in establishing a 401(k)/Retirement Plan for your company, our 401(k) Specialists will be happy to meet with you. They will take the time to review your options and assist in securing a Retirement Plan that is best suited to your company. Individual / Family BenefitsShould you or your employees need to look into individual lines of insurance, our Individual Account Representatives are available to answer your questions and compare several insurance plans. These representatives specialize in Individual Health, Life, Disability, and Dental plans. They can also help new or recently terminated employees with setting up a temporary health plan until their new coverage is in force. Organizational

|

Contact Info

6901 Rockledge Drive, Suite 700

Bethesda, MD 20817

Map and Directions

Phone: (301) 214-6700

Fax: (301) 214-6653

Quick Links

Quick Links

6901 Rockledge Drive, Suite 800

Bethesda, MD 20817

Phone: (301) 214-6700

Fax: (301) 214-6653